What is technical analysis?

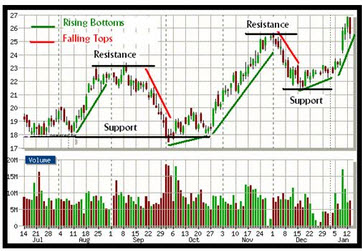

The two primary methods used to analyze securities for speculation and investment purposes are technical analysis and fundamental analysis. Fundamental analysis involves analyzing underlying factors in the asset. When you analyze share value for a stock company using fundamental analysis, you look at factors such as financial statements. With technical analysis, you will instead focus on what the market is doing. You don’t analyze any factors pertaining to the underlying asset – you just look at price movements to find patterns and pinpoint suitable moments for buying and selling.

The two primary methods used to analyze securities for speculation and investment purposes are technical analysis and fundamental analysis. Fundamental analysis involves analyzing underlying factors in the asset. When you analyze share value for a stock company using fundamental analysis, you look at factors such as financial statements. With technical analysis, you will instead focus on what the market is doing. You don’t analyze any factors pertaining to the underlying asset – you just look at price movements to find patterns and pinpoint suitable moments for buying and selling.

What is the Martingale strategy?

The Martingale strategy is a strategy for bet size. It was developed for the roulette table and is intended to use for a series of identical bets where the payout is 1:1. Today, some traders use the Martingale strategy when purchasing digital 100 options that pay 100% if they expire in the money.

The basics of the Martingale strategy:

- Each time you lose, your next investment will be double the size of the losing investment. So, if you invested $10 and lost, your next investment will be $20. If you lose again, the next investment will be $40, and so on.

- If you win a trade, you have recuperated your previous losses. Your next investment (if you elect to continue invest) should be the size of your original investment.

The Martingale strategy might sound mathematically sound, but the main problem is that a losing streak can ramp up the investment size really quickly. You might run out of money in your investment account and have to stop without having recuperated your losses and turned a profit.

If you are interested in the Martingale strategy, we strongly suggest you try it out in a demo account first.

What is the percentage strategy?

Some digital 100 option traders use the percentage strategy as a money-management strategy for their trading account.

The main idea with the percentage strategy is to decide beforehand how large a percentage of your bankroll that is allowed to be at risk at any given moment.

The main idea with the percentage strategy is to decide beforehand how large a percentage of your bankroll that is allowed to be at risk at any given moment.

Example: Eric decides to never have more than 10% of his bankroll at risk. Right now, he has $10,000 in his account. This means that once he has open positions amounting to $1,000 he will refrain from opening any new positions. When one or more positions have closed, Erik will take a look at his new account balance and see if there is any room for him to open new positions now or if he needs to wait for a few more positions to close.

Variant

Another strategy also commonly referred as the percentage strategy is the one used to decide how large each individual open position can be.

Example: Eric decides that each individual position can be no larger than 1%. He currently has $10,000 in his account. This means that he will not open any individual position larger than $100. It is a way of making sure that he spreads risk and doesn’t get carried away and invest a big heap of money into a “sure thing”.

Of course, if you want to cheat your own system, you will probably find a way. Eric could for instance purchase multiple very similar 100 digital options with the same underlying asset for $99 per option.

What is social trading / copy trading?

Some trading platforms have social tools that allow you to search for successful traders and automatically copy their trades, but within your own set parameters. You might for instance find a high roller who is really good with digital 100 options based on currency pairs. You elect to copy him, but you set the parameters to make much smaller purchases than he does. Also, you put a fairly low limit on how much money that is allowed to be at risk at any given moment.

What is algo-trading?

Algo-trading is short for algorithmic trading.

In algo-trading, a computer program is used to carry out trades in adherence to a defined set of instructions. As the use of the computer program, you give these instructions.

In algo-trading, a computer program is used to carry out trades in adherence to a defined set of instructions. As the use of the computer program, you give these instructions.

One of the advantages of algo-trading is that it makes it possible to trade at a speed and frequency very difficult to attain by a human trader. Also, the trading program can work 24/7 without the need for lunch, naps or bathroom breaks. You also take human emotion – such as fear and pride – out of the equation.

Algo-trading is also known as automated trading and black-box trading.

What’s a trading journal?

In a trading journal, you keep note of your trades and their particulars. This way, you can see how your trading goes over time and you might find interesting patterns that can be useful when you fine-tune your strategies.

Maybe you can see that you tend to make a profit when the underlying is stock, but make long-term losses on your digital 100 options that have currency pairs as their underlyings. Or maybe you notice that making trades in a Friday night when you are exhausted after a heavy work week is a bad idea. Or that all those seemingly small fees charged by Vendor A is killing your profits and that Vendor B is much better for your bankroll.

We are humans and our memory can not be trusted when it comes to trading. Some people will exaggerate their losses and having lost five trades with commodities as the underlying will grow in their brain into a huge IT IS IMPOSSIBLE TO MAKE A PROFIT ON COMMODITIES. Others tend to downplay their losses and remember their gains only, which can easily make a trader over-confident and keep him from making appropriate adjustments to his strategies over time.

This article was last updated on: March 6, 2018